Titanium is a “metal of the future” that offers ultra-high strength with low density and excellent corrosion resistance. It is predicted that the titanium alloy market will rise to 29.87 billion USD by 2030. How much does titanium cost per pound? Why does its price fluctuate like a roller coaster, sometimes soaring and sometimes falling? Is it due to a surge in aviation demand or geopolitical influences? In this blog, we will organize the current market price of titanium and analyze the various factors that affect it.

Current Titanium Price Per Pound

Commercial titanium alloys are mainly categorized into two main types, commercially pure titanium and titanium alloys, which are classified into several grades based on their oxygen content, alloying elements, and properties, and are used in different industries. The following are the major commercial titanium alloy types and unit prices ($/lb) based on the latest market data:

Commercially Pure Titanium

Grade 1: Lowest oxygen content, excellent ductility and corrosion resistance, suitable for deep-drawing and molding, chemical equipment (e.g., heat exchangers), and medical implants (e.g., dental stents). Titanium Grade 1 price per pound is about $6.00-$9.00/lb, it is the least expensive and suitable for large-scale civilian applications due to the lack of alloying elements and ease of processing.

Grade 2: The most commonly used commercially pure titanium, it combines good strength and corrosion resistance, and is widely used in the chemical industry (reactors), marine engineering (desalination equipment), and the medical industry (orthopedic fixtures). Titanium Grade 2 price per pound is about $6.50-$10.00/lb, it is in high demand and accounts for 40% of the pure titanium market.

Grade 3: Medium strength, suitable for pressure vessels and cold work components such as tanks and piping systems. Titanium Grade 3 price per pound is about $7.00-$11.00/lb, slightly higher than Grade 2 due to higher strength requirements.

Grade 4: Highest strength, used in aerospace components (e.g., fasteners), medical engineering (high-strength implants), and high-temperature environments. Titanium Grade 4 price per pound is about $8.00-$12.00/lb, near the lower end of the alloy range, with growing aerospace demand driving prices upward.

Titanium Alloys

Ti-6Al-4V (Grade 5): Commonly used alpha+beta alloy containing 6% aluminum and 4% vanadium, accounting for more than 50% of the titanium alloy market, widely used in aerospace (aircraft fuselage, engine blades, such as the Boeing 787), medical (orthopedic implants), and military (armor plate) due to high strength, corrosion resistance, and biocompatibility. Titanium Grade 5 price per pound is about $10.00-$30.00/lb, with high performance and complex processing (e.g., vacuum melting) driving up the cost, and aerospace-grade, high-precision products up to $40-$60/lb.

Ti-6Al-2Sn-4Zr-2Mo: High-performance α+β alloy with excellent high-temperature resistance for aero-engines (e.g. turbine blades) and high-temperature structural components. α+β Titanium alloy price per pound is about $15.00-$22.00/lb. and are higher than Grade 5 due to special alloying elements and high temperature processing requirements.

Ti-3Al-2.5V (Grade 9): Medium strength, good weldability and corrosion resistance for use in aerospace hydraulic lines, athletic equipment (e.g., golf clubs) and bicycle frames. Titanium Grade 9 price per pound is about $9.00-$15.00/lb, it is moderately priced and growing in civilian market applications.

Beta Titanium Alloys (e.g., Ti-15V-3Cr-3Al-3Sn): High strength, cold workable, used in aerospace fasteners, medical orthotics, and high-end eyeglass frames. The Beta titanium price per pound is about $12.00-$25.00/lb. The high strength and difficulty of machining make them expensive.

Factors Affecting Titanium Price

Titanium is a corrosion-resistant metal widely used in aerospace, medical, and other industries. Prices are affected by a variety of factors, including supply and demand, raw material costs, production technology, macroeconomic environment, geopolitical factors, and alternative materials. These factors are listed below.

Supply and Demand Dynamics

The balance between titanium supply and demand is the main price driver. When demand surges (e.g., due to increased aerospace orders) and supply is limited, prices climb. Conversely, weak demand or excess supply leads to price drops. The aerospace sector accounts for about 40% of global titanium demand, with large orders from Boeing and Airbus significantly affecting the market. On the supply side, titanium primarily comes from ilmenite and rutile. Constraints in mineral mining and processing capacity impact supply stability. For instance, in 2022, a pandemic-induced demand slump led to a drop in domestic titanium ore prices in Panzhihua, China.

Raw Material Cost

Titanium production depends on ilmenite, rutile, and other ores, with raw material price fluctuations directly affecting production costs. Major ilmenite producers like Australia and South Africa can see price increases if supply is disrupted by weather, policy, or logistics. In 2022, the global titanium ore market was hit by the pandemic and poor logistics, leading to lower downstream demand and falling ore prices. However, prices can quickly rebound during a tight supply. Additionally, titanium production is energy-intensive, requiring substantial electricity and natural gas. In 2023, rising energy costs led to price increases for titanium dioxide products.

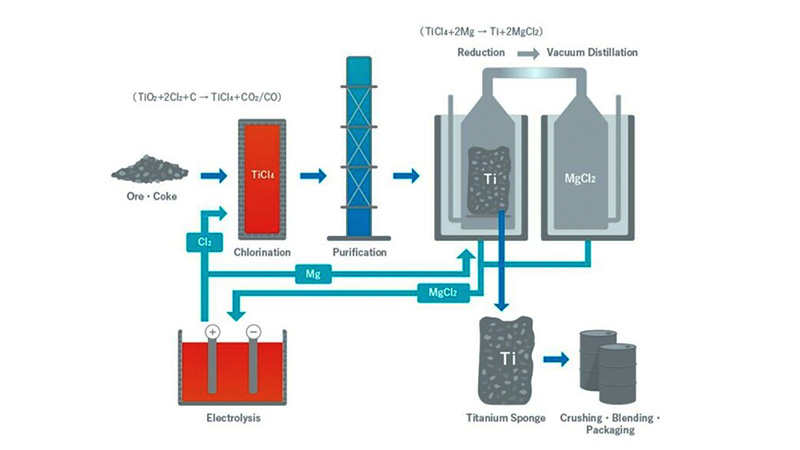

Production Technology and Process Cost

Titanium is mainly produced using the Kroll Process, which is complex and energy-intensive, leading to high costs. Technological advancements like efficient refining or recycling can reduce costs and prices. However, R&D and new technology implementation require significant capital, making it challenging to alter the price structure in the short term. For example, Xinpu Titanium Metal Materials Co., Ltd. recycles and processes 30,000 tons of titanium ingots annually, but high equipment maintenance and process costs still limit price reductions.

Macroeconomic Environment

Titanium prices are closely tied to the global economy. During economic booms, increased industrial and infrastructure demand leads to higher titanium consumption and prices. The global titanium metal market size was 35.525 billion yuan in 2024 and is expected to reach 52.379 billion yuan by 2029, with a CAGR of about 6.7%. This reflects the demand boost from economic recovery. Conversely, the 2020 pandemic caused a sharp drop in aerospace demand and low titanium prices. In 2024, China’s economic downturn led to record-low titanium sponge prices, demonstrating the direct impact of macroeconomics on demand. Exchange rate fluctuations also affect prices; a strong U.S. dollar can reduce demand in non-U.S. dollar regions, indirectly depressing prices.

Geopolitics and Trade Policy

Geopolitical events and trade policies significantly influence titanium prices. Major producers like China, Russia, Australia, and the U.S. can face supply shortages and price hikes due to trade disputes or export restrictions. For example, a change in U.S. tariff policy on Chinese titanium-based powders in 2025 led to a projected CAGR of 15.61% for the Chinese market size from $2.981 billion in 2024. Russia’s potential export restrictions due to geopolitical conflicts could cause global supply constraints and price increases. Tariffs and anti-dumping measures can also raise import costs and indirectly affect prices.

Alternative Materials and Technological Advances

The high cost of titanium has prompted the industry to seek alternatives like aluminum alloys or carbon fiber composites. If these alternatives perform similarly to titanium at a lower cost, titanium demand may decrease, leading to price drops. Carbon fiber composites have partially replaced titanium in aerospace applications. However, titanium’s unique properties in medical and high-end manufacturing make it irreplaceable in those sectors. The global titanium alloys market reached 6.5 billion in 2023 and is expected to reach 10.3 billion by 2029, with a CAGR of 6.3%, indicating resilient titanium demand despite the dampening effect of alternative materials.

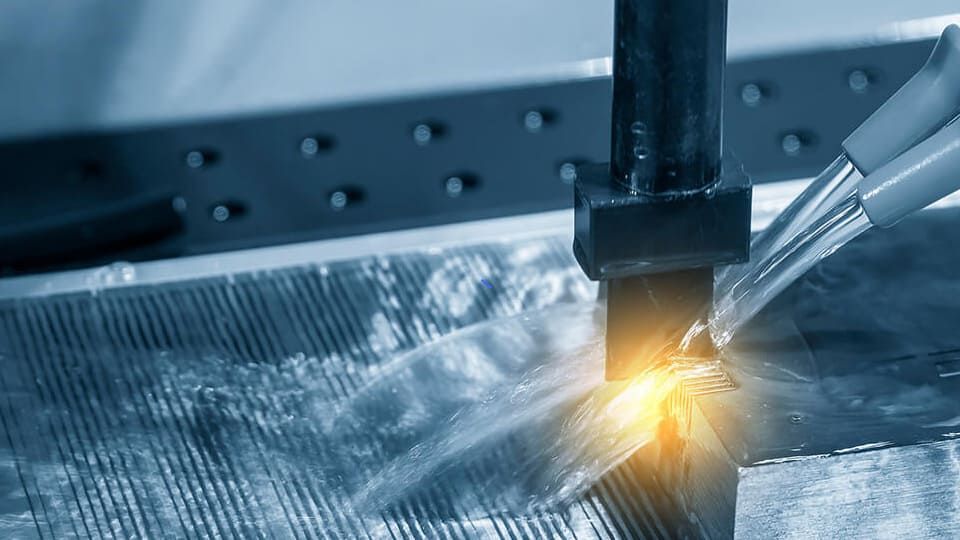

About SogaWorks

SogaWorks is an all-in-one online platform for custom mechanical parts, connecting over 1,000 top-tier factories to serve startups and major companies. We offer flexible manufacturing solutions for rapid prototyping, small-volume testing, and large-scale production with services like CNC machining, 3D printing, sheet metal fabrication, urethane casting, and injection molding. With our AI-powered quoting engine, SogaWorks can deliver quotes in 5 seconds, match the best capacity, and track every step. This cuts delivery times and boosts product quality.